Additionally, you may have to pay a prepayment penalty for paying off your loan ahead of schedule. Prepayment charges are normally set at 2% to 4% of your original loan quantity, according to Realtor. com (how do real estate agents make money). While your house owners insurance normally covers the structural elements of your house in the event of damages caused by fire or specific kinds of natural catastrophes, a home warranty has a various scope.

com, house guarantees can cover repair work and/or replacement costs for cooking area home appliances and the washer and dryer, in addition to the electrical, plumbing, and heating and air systems. You can offer to buy a warranty to cover the house leading up to closing, so the purchaser understands they're not dealing with repair work costs as quickly as they sign.

A purchaser warranty can cost in between $300 and $600, according to Realtor. com. It's a good perk to provide buyers, however it's not a requirement. By now, you might think you've ended up spending for all the expenses of selling your home. However as you are preparing to relocate to your new house, remember to take the following expenses into account too.

3 elements that affect moving expenses are: Whether you're moving a short or cross country The variety of home products you're moving Whether you're moving yourself or working with expert movers Working with expert movers has its benefits. A full-service mover can deal with packing your possessions, moving them to your brand-new house, and unpacking them.

HomeAdvisor quotes the cost of professionally moving a three-bedroom home locally at $760 to $1,000. Movers charge more for longer range relocations and to transport heavy or bulky items, such as a piano or your kids' swing set. For a DIY move, renting a moving truck can cost just $50 or over $2,000, according to HomeAdvisor, depending upon the size of the truck and the variety of miles took a trip.

You'll also require to spend for boxes, tape, and other packaging materials. If you have things that need to be discarded, you may also need to pay for either a portable dumpster Click for info that can be chosen up, or to have somebody how to get out of a hilton grand vacation timeshare haul those products away. Lastly, you might require to pay deposits for electrical, gas, water and garbage collection at your new house.

The Ultimate Guide To How To Get Leads In Real Estate

HomeAdvisor suggests the cost of a relocation may be twice as high during the summer season. From May to September, need for moving trucks and professional moving services peaks, as households often move in summer season while school is out, and university student relocate to and from school. Higher competition for moving services frequently results in higher rates.

If you've already closed on a brand-new place, you may pay ownership expenses for 2 houses simultaneously. That can consist of both home mortgages, energy expenses, HOA costs, home taxes and house owners insurance. If you have not closed on the brand-new home or you're still browsing for the right one, you'll require to spending plan for momentary living arrangements.

According to SpareFoot, the typical month-to-month expense of self-service storage varieties from around $66 to practically $135, based on the size of the unit. Keep in mind, in this circumstance you may need to move twice, which aside from being time-consuming, can likewise be very costly. Our analysis of internal and industry data suggests that together, shift costs typically amount to about 1% of the price, presuming a transition bluegreen timeshare cancellation policy period of one and a half months (what is a real estate novelist).

There are typically more costs to selling a home beyond genuine estate representative commissions10% of the sale price is a great location to begin. Take some time to calculate each of the costs listed here individually, presuming they use to your circumstance. The more accurately you have the ability to approximate the overall quantity you'll pay, the less space there is for surprises.

In the table below, we break down typical home offering expenses, presuming a deal price of $248,000 the average single-family home price in the U.S. in the fourth quarter of 2018, according to NAR. You can see that when you take all the expenditures into account, the overall expense of offering reaches over 16% of the list price.

$ 248,000 Staging costs $2,480 1% Home repair work & renovations * $12,400 5% Genuine estate agent commissions $14,880 6% Seller concessions $3,720 1. 5% Closing costs ** $2,480 1% Shift and overlap expenses $2,480 1% Moving costs $2,480 1% $40,920 16. 7% $207,080 * For repair costs, we took the national average in 2018 according to homeadvisor.

9 Easy Facts About What Is Escheat In Real Estate Explained

Editor's Note: This post was initially released in March 2013 and has actually been upgraded with the most current info. In theory, it's easy. The real estate agent notes a house for sale, you like it, you work out a price with the representative, the seller accepts, the home closes, and the seller pays 6 percent to the broker as their charge.

There are 2 kinds of representatives: purchasers' agents and sellers' representatives. In the Hamptons location, purchasers' representatives are virtually nonexistent compared to other parts of the nation, most likely since realty attorneys sub somewhat for the buyer's agent throughout the agreement stage of the deal. If you see a home you like and call the agent and ask to see it, you're dealing with a sellers' agent.

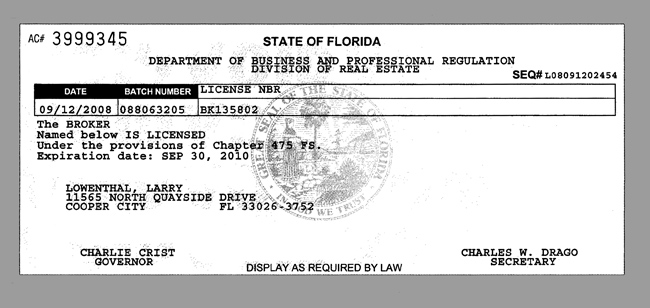

However what's the distinction in between representatives and brokers? Both realty agents and brokers should be accredited. Brokers must pass a harder exam than representatives, but aren't always more experienced. Agents work for brokers; they are licensed to offer property however they can't work separately. Some brokers work straight with home buyers and sellers, and some have a staff of representatives working for them.

Usually, the cost a seller pays a broker is 6 percent, however that can vary. That fee is for a full-service brokerage. Cut-rate brokerages are also becoming better known, but are less popular in the high-cost Hamptons. However, fees might be flexible, most likely more so in smaller brokerages. Representatives are most likely to accept a 5 percent commission if the seller is a repeat client or purchasing as well as selling.

Representatives usually are paid a percentage of the commission gotten by the brokerage from the sale, sometimes just 30-40 percent. Top representatives receive more. In addition, leading representatives get what's understood as a "split" or, a percentage of the commissions they generate. This is normally an aspect that adds to the broker's ability to bring in leading skill in the industry.

Normally, purchasers do not pay any commission on their side - how to get a real estate license in ca. The transfer taxes will be of biggest concern to buyers and making sure to record fees and anything related to financing throughout the process. Do your research study and bear in mind that you are the one on the hook for paying hundreds of thousandsif not millionsof dollars for this home.